EFC Tune-UP™ Calculates Your EFC, Provides Reduction Strategies,

And Measures College Affordability | Generosity

EFC Tune-UP™ Five Step Process

Step 1 – Project Expected Family Contribution (EFC))

Step 2 – Lower EFC Strategies

Step 3 – Evaluate Aid Eligibility By School

Step 4 – Determine College Affordability

Step 5 – Identify Generous Schools

Dorothy Speaks About Coach-for-College Service

“Given my status at the time, I felt completely lost and was afraid to make the wrong move given the risks. I wanted guidance and wasn’t completely sure who to turn to. I exchanged emails with Mr. Kuhner then moved forward with his coaching service. I feel that coaching helped me reflect on the current situation better and see different point of views. I definitely received information which I do not think could come from another source. My entire situation was nerve wracking, and I did not feel I was prepared to handle it on my own. Now, I feel great that my problem is resolved. And even better that I have gained knowledge I did not previously know or fully understand. It was also a pleasure working with Mr. Kuhner (Coach-for-College), who was nothing but professional in assisting me.” – Dorothy D.- New Jersey

Step 1 Calculate Your EFC

- When You Enroll, we’ll email you and set up a “get acquainted” phone call.

- You will receive a link to our online EFC Calculator where you input some data, then securely upload the data into our financial aid software (Your time 10-15 minutes). Or, if you prefer we can do it over the telephone.

- If you already know your EFC number and you are satisfied, then we’ll proceed to step 2.

Step 2 Lower EFC Guide

- Assessable and Non-Assessable Assets | Income including the treatment of Home Equity/Small Business Interests.

- Additions and Deductions from Financial Aid Income

- Untaxed Income and Benefits; certain tax deductions become additions to financial aid income.

- What are EFC Allowances and how they benefit you?

- Income and Asset strategies for the student and parents that lower your EFC number.

- Ways to Maximize Financial Aid Opportunities with student positioning.

- BONUS Section: Rental Property Owners, How to Exclude Rental Property from FAFSA!

![]() Strategy Alert: Financial Aid forms are imperfect making schools unaware of special circumstances affecting your family’s ability to pay for college. We will show you how special circumstances can lower your income and assets.

Strategy Alert: Financial Aid forms are imperfect making schools unaware of special circumstances affecting your family’s ability to pay for college. We will show you how special circumstances can lower your income and assets.

Step 3 Evaluate Aid Eligibility by School

Percentage “Need Met” is the average percentage of a family’s demonstrated financial need a school provides in their financial aid award to the students.

If a school need met is 80%, then on average the school meets 80% of the families demonstrated financial need (DFN). Need is defined as the Cost of Attendance (COA) less your Expected Family Contribution (EFC).

When a school does not provide 100% funding for the a family’s financial need, then the difference is the “funding gap”.

Calculation of Family Funding Gap Using Your EFC Number

| Cost of Attendance | $60,000 |

| Less: Expected Family Contribution (EFC) | $30,000 |

| Demonstrated Financial Need | $30,000 |

| Times Percentage Need Met @ 80% | $24,000 |

| Family’s Funding Gap | $6,000 |

Strategy Alert: The EFC is your starting point. It is the minimum your family is expected to contribute for the student’s education. The COA is what it is in most instances. But the EFC is based on a formula, understand the formula and you increase your chances of lowering your EFC which as you know now, increases family’s DFN.

Some students will pay less than their EFC. They are receiving merit aid or scholarships which can be independent of financial need.

All of our discussion to this point pertains to needs-based financial aid.

How do you know if you qualify for needs-based aid? Subtract you EFC number from the school’s COA. If negative number, then your financial aid situation is considered non-needs based. If positive, you are needs based.

Non-needs families can qualify for merit aid/scholarships, but the percentage need met is irrelevant to the non-needs based family except as a generous school indicator.

However, pay attention to the school’s cost of attendance because you can be non-need based with one school and need-based with another.

Step 4 Determine College Affordability

Now that you understand the basics of determining your financial need, be proactive in your college selection process with financial aid modeling. Here is what you will learn.

- Before/After analysis of any EFC reductions strategies that can increase your financial aid

- How to leverage financial aid eligibility reporting?

- Compare up to Five Schools Side-by-Side

- How to create our Competition Wheel among relative schools.

- Why you must examine a school’s Average Freshman Profile when you build your College ist.

- Bonus One: How to use Student Positioning for Admissions and Financial Aid Success?

- Bonus Two: How to increase your chances for Merit Awards (free money)?

Step 5 – Find the Most Generous Schools Compare Step 4

The percentage need met measures a school’s generosity. There are about 70 schools that meet on average 100% of a student’s financial need. Some of these schools provide full need without any loans.

Most schools do not meet full need, and some schools are below 50% need met.

Students with need fully met percentage measures generosity one step further.

For example, Baldwin Wallace University provides on average 88% of need met. But, they provide 71% of need fully met to their student community. In other words, if you attend the school you have a seven out of ten chance your your financial aid award will be 100% of your family’s financial need.

Another generosity indicator is the allocation between between grants and self-help (loans and work-study within the financial aid award.

Needs based financial aid consists of Gift Aid and Self Help.

Gift Aid as the names implies does not have to be paid back, grants and scholarships fall into this category.

Self Help includes student loans and federal work study.

Aid without need is provided in the form of grants to students where family’s EFC number is greater than the cost of attendnce.

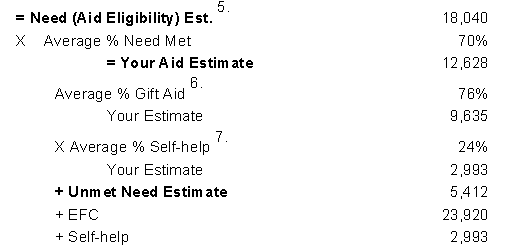

Below part of the financial aid eligibility report demonstrates average % need met that that constitutes needs based financial aid.

Percentage Need Met , Gift Aid and Self Aid Percentages, Valuable Information For Several Reasons

![]() Strategy Alert: Projecting the funding gap before financial aid awards come out is crucial because you will be more informed to evaluate the awards. Also, there is little time to decide before the May 1st deposit deadline for many schools. Remember the FAFSA dictates the federal Title IV Financial Aid awarded regardless of school.

Strategy Alert: Projecting the funding gap before financial aid awards come out is crucial because you will be more informed to evaluate the awards. Also, there is little time to decide before the May 1st deposit deadline for many schools. Remember the FAFSA dictates the federal Title IV Financial Aid awarded regardless of school.

Reporting That Provides You

With School Specific Information

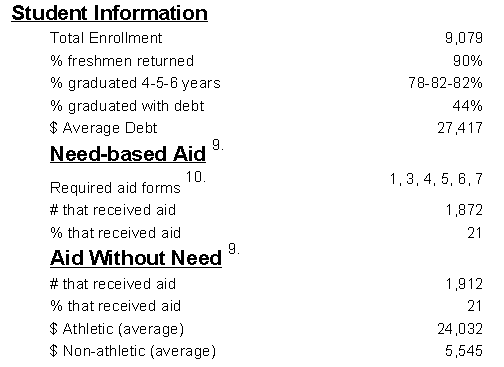

The school information below is also included in the Financial Aid Eligibility report.

This information becomes very valuable when making conclusions about step 5 and step 4 information. Of particular note is freshman retention rate, graduation rate , and average student debt.

Failure to graduate in four years (only 35% do) is arguably one of the most costly mistakes going to college.

High income families can examine the average merit aid award without financial need, example below $5,545.

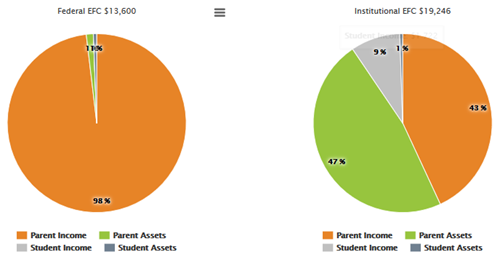

EFC Calculator Software Report

Once we solidify your EFC number, the EFC software produces a report showing the components of your EFC number for analysis. Here is a sample.

- Pie Graphs of FAFSA EFC and CSS PROFILE EFC showing Parent and Student Income and Asset Contributions to the Family EFC number.

Remember, Two Approaches Can Help Your Family

Reduce Your EFC Score? Minimize Foolish Mistakes!

There are two important considerations when examining how you can reduce your EFC number.

- First, see if you can minimize you your EFC number. For success you must understand the terminology (or hire someone that does) within the EFC calculation then how the rules dictate the result. EFC Tune-UP™ goes through a check-list of possible reduction strategies reviewing “now”” and possible “reduction strategies” into the future..

- Second, eliminate mistakes that can result in a higher EFC number than necessary, this is where understanding both the terminology and the rules are paramount!

![]() Strategy Alert: EFC Tune-UP includes detailed analysis of of how income and assets are reported that allows you to consider what strategies within the rules you might consider based upon your family’s financial situation. The objectives are simple, make the most informed decisions and eliminate surprises.

Strategy Alert: EFC Tune-UP includes detailed analysis of of how income and assets are reported that allows you to consider what strategies within the rules you might consider based upon your family’s financial situation. The objectives are simple, make the most informed decisions and eliminate surprises.

WHAT Does EFC Tune UP™ Do For You

How Can It Help You?

- Verify Your FAFSA Expected Family Contribution and project your CSS PROFILE when necessary.

- Look at ways to decrease your EFC and help you eliminate financial aid mistakes.

- You select colleges and we provide Financial Aid Eligibility information.

- We provide two page informational guides for each of your selected colleges that provides key metrics and saves you a tremendous amount of time and frustration search college websites.

- Some Strategies are time sensitive, longer you wait the lower the impact.

Is This Going To Be Complicated?

No. You should be able to complete the calculator information in less than 15 minutes.

Our explanations are broken down into modules using power point slides when providing rules, for example what are deductions from financial aid income? They are listed on a slide/s.

Please remember, the information we provide is personalized to your family’s individual financial situation.

Obviously we never share your information with anyone.

Is the EFC Tune UP™ Affordable?

Personalized Family EFC Financial Aid Reporting

Here are the steps for your EFC Tune-UP™.

1. When You Enroll, we’ll email you and set up a “get acquainted” phone call.

2. You will receive a link to our online EFC Calculator where you input some data, then securely upload the data into our financial aid software.

3. We’ll review your results, provide you a summary of your EFC calculation and provide any suggestions that might lower your EFC, providing you a before and after graph that itemizes the recommendations.

4. Based upon colleges that you select or we might recommend, we’ll provide you Financial Aid Eligibility comparisons that show schools side-by-side, 5 per page up to 25 schools.

5. The Financial Aid Eligibility information can be used when you receive your financial aid award for appeal consideration – remember some schools send low-ball financial aid awards. If they report their need- meet as 85% of financial need and their award to your student is 40% then an appeal might be in order.

Some Common Questions

1. Am I limited to 25 schools? No, we are suggesting that number because in most situations that probably is enough.

2. Is the EFC Tune UP™ just for High School Seniors? No.

Current college families (except seniors) can benefit by determining if they can lower their EFC score and compare their school reported financial aid award percentage need met with their current award for appeal consideration.

High School Freshman, Sophomore and Junior families will benefit by learning how the EFC process works inside the financial aid system.. Here are the benefits;

- When considering family financial choices during high school you can evaluate how each choice affects your EFC calculation helping you avoid costly mistakes.

- As you consider school for your admission list you can evaluate the family affordability issue and compare net costs for each school.

- You can use student positioning and school admission criteria to qualify for more financial merit/scholarship aid and reduce the school’s net cost.

- When you receive school financial aid award packages you will know if they are fair based upon the school’s historical “need-met” practices. You will be in a much better position to compare school offers and to file an appeal/s for more financial assistance.

3. How long do I have to request the Financial Aid Eligibility reports for the selected colleges? There is no time limit we just ask that you are reasonable in making relevant requests that are applicable to your situation.

4. What does funding gap mean? It is the anticipated difference between the cost of attendance and the projected financial aid award, another name would be “out-of-pocket costs”. This provides a meaningful way to compare college affordability in the selection process. Of course the final decision rests with the actual awards provided by the various schools in your application pool.

Parent’s Achieve Financial Clarity™

Manage your EFC process; see if you can lower your EFC number today and strategies for the future.

Make future family financial decisions with an understanding how they affect your EFC calculation and your financial aid.

Measure college affordability with financial aid modeling, compare possible financial aid awards between schools to determine which are more affordability…an very important step in college selection.

Start Now so You can Learn How the Financial Aid Systems Works?

Schedule a Phone Consultation

Jim Kuhner

Email: [email protected]

or Call Direct (817-600-0576).

How to

How to