What is the Difference – Grant Aid and Scholarships

Are you curious when you hear about all the “free money” that does not get claimed and therefore not paid out each year?

Frankly a big reason this occurs is that families do not properly plan for college.

Let’s define exactly what a “Grant” and/or a “Scholarship” means.

It is very important we understand grants/scholarships can have many qualifying / selection criteria such as sports, academics, “for service standards”, etc. It makes sense when we review the actual definition of the word “scholarship” to determine why we are just referring to both as grant/s.

Meriam Webster Dictionary defines it this way;

- “a grant-in-aid to a student (as by a college or foundation)”,

- “the character, qualities, activity, or attainments of a scholar”.

For simplicity purposes are going to simply refer to both as grant/s or grant aid. There are many sub-sets of this broad definition.

![]() [Strategy Alert:] Now not to confuse but in reality there can be a difference and you need to watch out for this when you receive your financial aid awards. “Generally” a scholarship is awarded and as long as the published minimum standards are satisfied it renews itself each year. On the other hand a grant has to be renewed through the financial aid process. Pay attention to how each school’s policy addresses scholarships and grants on what is on your financial aid award.

[Strategy Alert:] Now not to confuse but in reality there can be a difference and you need to watch out for this when you receive your financial aid awards. “Generally” a scholarship is awarded and as long as the published minimum standards are satisfied it renews itself each year. On the other hand a grant has to be renewed through the financial aid process. Pay attention to how each school’s policy addresses scholarships and grants on what is on your financial aid award.

Using our definition (we will consider them synonymous for this discussion) we are going to review a systematic process to both understanding grants and how to qualify for grants.

- How grant aid works, see University of Rochester grant example,

- Why and to who Private Colleges want to grant these financial awards,

- A 3-step formula for qualifying for college grants,

- Why you want to pursue grants, the long term costs of not receiving them,

- How to search for grants with student positioning at the front of your strategy.

In the University of Rochester example, contrary to what many perceive there are many “non-academic” monetary awards.

![]() [Strategy Alert]: Private College Grants can be both federal and institutional based. Federal grants are based on financial need whereas institutional based grants are not controlled by the Health Education Act, the colleges can make their own grant giving decisions.

[Strategy Alert]: Private College Grants can be both federal and institutional based. Federal grants are based on financial need whereas institutional based grants are not controlled by the Health Education Act, the colleges can make their own grant giving decisions.

- Grants or merit aid are really tuition discounts awarded by the Colleges to attract students in their admission / enrollment process.

- Traditionally grants have been awarded to attract students from high income families so the respective college could win the student from a competing college.

- You really need to research the colleges and how they award merit / grant aid especially with their reported average financial need packages. Determine the average package amount and then look at the average merit award. Some Colleges load the packages with loans, you want to know that when considering Colleges for application.

Colleges Want To Give Out Grant Awards to Above Average Students

Why Grant Aid? Privates’ Have A Selfish Reason

- College expenditures on grants improve student retention and graduation rates.

- Grant expenditures improve student choice.

- Free money can attract high achievers

- Colleges’ grant giving practices can improves the quality of their student population relative to the colleges they compete against.

3 Step Formula For Qualifying College Grant Aid

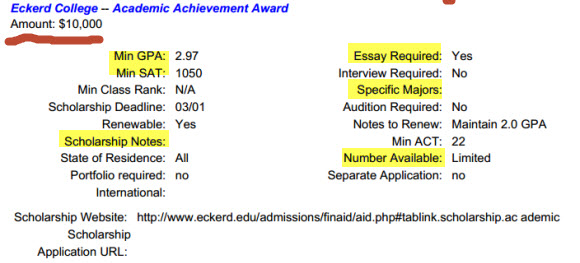

Let’s get some semantics out of the way. There are a variety of names for these scholarships awards, grant-in-aid: merit scholarships, awards of merits, academic merit awards, merit aid scholarships, tuition reduction awards, Presidential Awards, etc.

In fact, even a “legacy award” (family member graduated from the school) can fall into this broad class because it is free money.

Most awards have some criteria, high SAT ACT Test scores and GPA are certainly prevalent but when you consider “character, qualities, activity, and attainments of a scholar”, with some focused effort you can win free money awards.

So as you can see, there is more opportunity than many might think.

Step 1 – Knowledge Of “Grants”

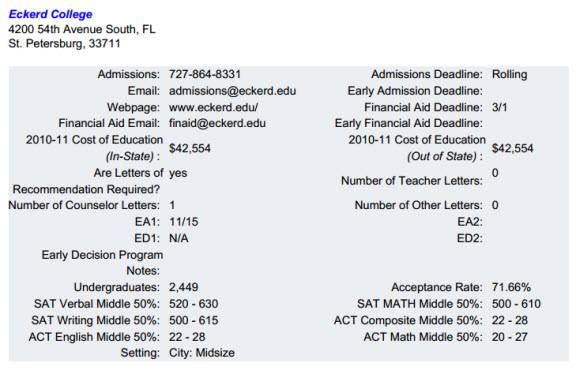

This is self-explanatory, you have to know these answers – What- Amounts, Where- Sources, Why- Qualifications, When- Deadlines, and How- Applications.

Step 2 – Process With Systematic Approach Proprietary Search Engine Access

Processing the information can be time consuming and daunting so you need a streamlined approach that targets the best awards for your individual situation and the schools on your target list.

There are numerous sources available but our MAP search engine “averages $12,000” per award.

Step 3 – Execution of Scholarship Merit Award Applications

“The Only Failure Is The Failure To Engage”! You need “accountability” that the first example happens, or you will be back to earlier statement of all that money that goes unclaimed every year…you have heard that, right?

Many grants are provided without application but you want to know what is available so you when possible you can position your paperwork to improve your chances.

Why is grant money so important?

What Is In It For YOU When You Receive Free Grant Money from Colleges? Our Analysis will Surprise You!

Money to pay for college comes from three sources.

- Free Money,

- Borrow,

- Pay Cash.

We will look at three comparisons using the amount of $9,000;

- Receiving Grant Money,

- Borrowing the same amount of money repaying it back,

- Using your money paying cash out-of-pocket.

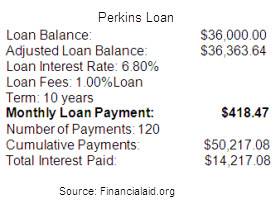

$9,000 per year would be $36,000 Free Money for 4 Years, but first let’s look at the other end of the “financial train wreck” – loans as opposed to grants.

Borrow, Repay, Lost Opportunity Costs

What happened if you borrowed the $36,000 and had to pay it back!

As you can see in this example, your payments total $50,217.08 with a monthly payment of $418.47 for 10 years.

So the net impact on your financial health in this discussion the $50,217 you had to pay back and the $36,000 you never received [$36,000 in “free money” outlined in example one above].

But there is something more, the “Lost Opportunity Cost” on that $418.47 monthly payment. What if you would had been making interest on that?

Using the same interest rate as the loan, 6.8% compounding “annually” which is the most conservative way: $70,871.32.

LOST OPPORTUNITY COSTS – So if you received the merit aid of $36,000, and started saving the repayment you would have had your financial health would be improved by $70,817.32 (for simplicity were not looking at tax issues or types of savings).

Sometimes borrowing is necessary, then the important strategy is to borrow smart repay smart.

Pay Cash

You could pay cash, using the same $36,000 as in the above two examples over a 10 year horizon using the same interest rate would amount to $69,504 counting interest lost of $33,504.

However, since this is money forfeited for ever and lost to retirement, over 20 years the loss accelerates to $134,192 with lost interest of $98,192. And this is a small part of the potential out of pocket cost.

The of “Value of College Free Money” through grants, merit aid, tuition discounts, etc. is very real when you consider the math.

The Key To College Free Money Is To Make Sure

You Use The College Free Money MAP™

- Proprietary Search Engine with Selection criteria

- Screen Merit Awards, Essay Required?, GPA, SAT ACT Scores, etc.

- These Are Scholarship Awards Offered by Colleges

- EFC Tune-UP™ determines colleges average merit aid award – needs-based and non-needs based (high income families).

- Cash Flow and Tax Reduction Strategies

- Personal Coaching using our proprietary software

- Pre-built organizational tools

If You Want Professional Help, We Are Here

We Can Help You Find Money to Pay for College?

- “MAP” stands for Merit Aid Portfolio.

- Coaching Class for Parents and Students

- Build Your College Target List With One on One Coaching Help

- We’ll Examine Possible Cash Flow Strategies for Parents

- Coach-for-College Customized College Plan Funding Guide™

- 10 Primary “Strategy Classifications” Validating Merit to the College

Grant Award Search Engine Starts The Process

Saves Time, Zero In On The Free Money, Benefits Can Be Large

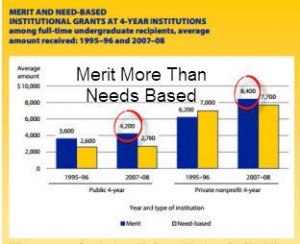

Merit Financial Aid is “awarded” based upon financial “non-needs” basis.

Contrary to common belief, you don’t have to be an “A” student to receive merit aid.

Do you have individual achievements and talents with or without high academic marks?

You will want to build a Personal Portfolio that starts with a career profile and choosing your major.

Let’s take a look at where merit aid comes from and how to position yourself for merit aid.

Contrary to what many think, the average amount awarded for merit aid is larger than the average amount for “needs based” financial aid.

Each college establishes criteria based upon certain student qualities they are seeking.

Students who wish to be considered for merit scholarships should position themselves.

Identify Grant Aid By Selection Metrics

Search By GPA | SAT ACT Score | Requirements? | Essay Required | Majors? | Renewable?

Even if you are not interested in some schools in a state but you are interested in one school, then you want to know what competing colleges in the same geographic area are offering.

Our Free Money Map™ search engine allows you to search by grade point average, SAT and/or ACT score, and by state and other criteria.

Student Positioning Criteria

College Free Money Map™ Includes 10 Primary Award Factors

There are ten primary factors that consist of successful student positioning with some additional elements that can contribute to success in winning tuition reduction awards (merit scholarships/merit aid).

Join The College Free Money Map™ Program

- Coach-For-College Written Customized College Action Plan

- One-on-one Personal Coaching, Cash Flow / Tax Reduction Strategies

- Access to our Free Money Map™ Search Engine

- Pre-Built Excel Spread Sheet to Track Your Targeted Scholarships

- Access to ePrep Test Prep @ 40% Off Retail – Colleges grant money for above average scores!

Money MAP™ Website answers these question, “How does the student stand out besides test scores, grades, and class rank?” Optional – have your own Merit Aid Portfolio Online.

Contact Jim Below for Information

- Career Selection Profile

- Personal Performance Profile

- Recommendation Profile

- Community Interest Profile

Jim Kuhner

817-600-0576

** [Note: Statistical and graphic information from US Department of Education “Stats in Brief Merit Aid For Undergraduates]

JimKuhner

How to

How to