College SAVE™ – Solutions, Access, Value, Education

COACH-For-COLLEGE™ Get the Answers You Deserve

- Eliminate Costly Mistakes

- Save Time, Reduce Debt – Old and New

- Reduce Unnecessary Out-of-Pocket Expenses

- Graduation in Four Years…Have you seen graduation rates?

“The Only Failure Is The Failure To Engage”!

What Is The Purpose Of Our Coaching?

In working together, we can accomplish these three core objectives;

- Students Choose Right College™

- Parents Achieve Financial Clarity™

- Families Experience College Success™

Going to College is complex and there are many strategies to consider.

We focus on an efficient learning delivery system, a change in “mindset”, a Veritas for College™ approach.

- Knowledge

- Process

- Execution

Check out our Starter Coaching Program

High College Costs Makes It a Necessity to Graduate in 4 Years, Not 5 – 6 Years

Graduation rates in four years (24% source Huffington Post Infograph) are terrible because many times there are no career goals and no major selections prior to going to college, or there is a change (sometimes that can’t be helped).

When the student “buys in” to a plan of action prior to attending college chances are much higher that graduation will result in a 4 year diploma.

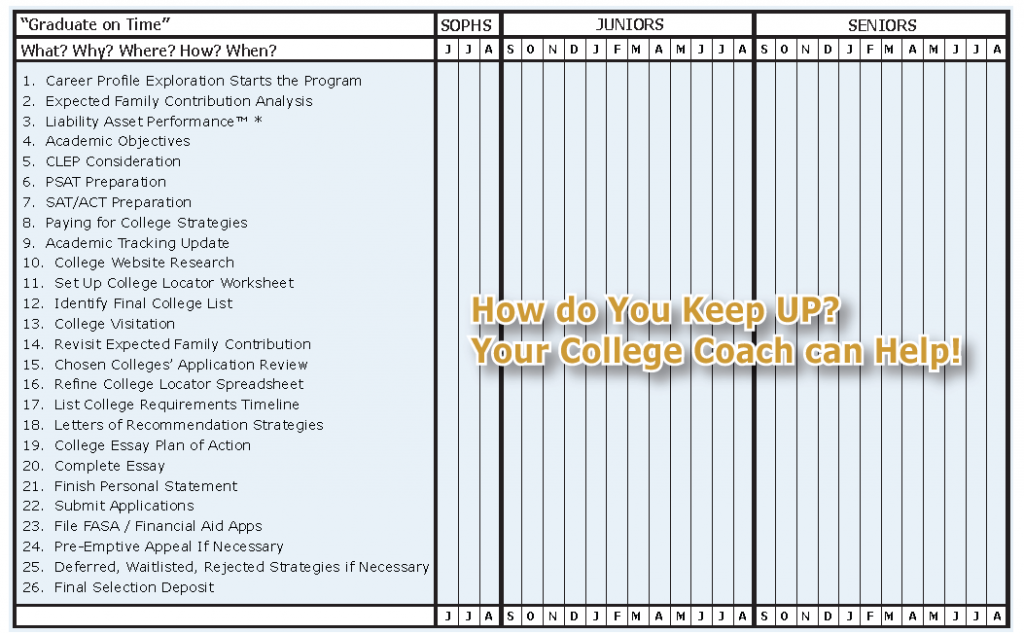

Partial List of Planning Steps We Provide

The above information represents some of the key “tasks” that should be addressed or dismissed when planning to go to college.

A systematic approach will save you much more money than our coaching fees, Guaranteed.

However, Coach for College not only addresses planning for college bound issues but we go way deeper in helping your overall financial situation so you can afford to go to college.

Here are some examples of concepts that can be covered based upon your family financial situation and objectives. Of course, not all will apply to you but many can and will be addressed when you join Coach for College.

Education Tax Relief Can Improve Your Cash Flow, Pay off Debt, Pay for College

- HOPE – American Opportunity Tax Credit

- Lifetime Learning Credit

- Student Loan Interest Deduction

- Tuition and Fee Deduction Strategies

- What is a Qualified Expense?

- Scholarships and Fellowships…When are they Taxable?

- Coverdell Educational Savings Accounts (“CESA”)

- Qualified Tuition Plan

- Student Loan Interested Deduction

- Penalty Free IRA Withdrawals

- Section 127 Tuition Assistance Plans

- Section 105 Medical Reimbursement Plans

- EE Bonds

- Above The Line Education Deductions

- Small Business Owner Strategies

- Harvest Tax Losses

- Tax Advantaged Income Generators

Trained College Planner Tips, Tricks, and Traps

- Basic ways to increase financial aid and some “advanced” ways

- Timing is everything, coaching helps you not miss deadlines

- Which Colleges will give you the most money?

- What is affordable for your family?

- Personal debt is your enemy, software Borrow Smart Repay Smart™ provides borrowing clarity

- Spend student money now / auto, computer, etc.

- Defer Grandparents’ Gifts for education until Junior year or upon graduation

- Saving money in student’s name is a mistake

- Delay Income if possible, Primary Driver of EFC Calculation

- Avoid capital gains

- Plan Early if Possible, Watch Retirement Plans!

Student Positioning for Merit Aid / Scholarships / Admissions

- 10+ Major Criteria for Marketing the Student for Admissions /Merit Aid / Tuition Discounts.

- Academic Strategies During High School / Identify What Your Target List of Colleges are Looking For!

- College Credit for “Discounted Dollars” – AP / IBC / What About CLEP? Match Your Schools

College Visitation Do You Have A Plan…What About Your “Memory Hook” Strategy?

- Student Personality versus College Personality

- Demonstrating Interest when you visit schools.

- What to ask – Questionnaires with Ranking Criteria

- Minimum Visitation – Admissions, Financial Aid Office, Career Placement Office, Optional: Faculty, Athletic Department, Current Student/s

- Ranking the Colleges or are you making a common mistake?

Saving For College If You Have Time?

- 529 Plans…Earnings “Can Be Taxable” – “Double Dipping”

- Government Bonds

- UGMA & UTMA

- Coverdell ESA Plans

- “Why and Why Not” Permanent Life Insurance, Is it right for you?

- Annuities, How They Work in the EFC Formula

- IRA / Roth IRA

- Tax Capacity / Income Shifting

Financial Projections And Reality, Data Input, Output Solutions

- “Need Met” of Colleges – There’s a basic misunderstanding, private schools can be more affordable than public!

- Calculation of “Short Fall” – Don’t wait until you get your “Damage Report”, be Proactive, Get a Plan of Action.

- Paying for the “Short Fall” – What to do before your College Bill arrives.

- Grant Money from Colleges/ Scholarship Search / Positioning…It’s about some effort, millions go unclaimed each year.

- Student Resources, this is not about money. Each student has a unique “offering” to the “right school”.

- Career Strategies…Why are you going to College? Let’s have a reason, a plan, and motivation for success.

Jim Kuhner, College Planner, can be reached at 817-600-0576.

[email protected]

How to

How to