FAFSA and CSS PROFILE Can Differ in Untaxed Income Benefits

Untaxed Income Benefits increase your Financial Aid Income (AI) in the Expected Family Contribution (EFC) calculation.

Certain income and benefits although not taxable can become untaxed income which counts in the AI.

The FAFSA asks for possible untaxed income in question # 94a through #94i.

Plan early so you are not surprised.

See our examples of untaxed income below in our questions and answers discussion including strategy alerts.

Some types of untaxed income can either be avoided or delayed.

EFC Rules Are Opportunities When You Plan Ahead

The Role Untaxed Income Plays in the EFC Formula

The EFC formula calculates the student and the parent/s separately, then combines the two to reach the total EFC.

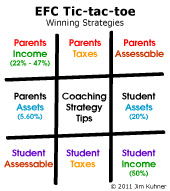

Just Like Tic-Tact-Toe It’s All About Strategy

- Focus One Square At A Time

- Score Your Win With Lowest EFC Possible

- Learn the Rules or Save Time and Mistakes Hire Someone for Help

FAFSA EFC Tune UP

We List the Rules for You

The FAFSA starts with student and parent/s assessable income and assets.

From there, counted income and assets contribute to Available Income (AI).

Certain types of income and assets are not assessable. How income and assets are treated is the primary difference between the FAFSA and the CSS PROFILE.

There are certain allowances (deductions) and additions to AI .

There are two financial aid forms; FAFSA (Federal) and CSS PROFILE (Institutional).

All schools who accept Federal aid money (example, Pell Grant) require the FAFSA.

There are about 200 undergraduate schools who require the FAFSA and the CSS PROFILE.

There are three financial aid methodologies; FAFSA, CSS PROFILE, and the Consensus 568.

As you can imagine, there are rules about rules. Rules, or the lack of knowledge thereof, can result in costly mistakes.

Personal Coaching Can Help You

- Build your knowledge base with access to the Financial Aid Boo$ter

- Project Your EFC Number, manage your EFC components

- College Cost Comparison Report Shows Amount / Type of Possible Financial Aid by school.

- Identify the College Cost Surprise ” Funding GAP”, what you probably owe after your EFC obligation.

- Cash flow strategies that can help cover your “funding gap”

9 FAFSA Untaxed Income Questions With Strategy Tips

QUESTION # 1: I contribute to a 401-k and my employer matches what I put in up to 3%. Does my 401-k contribution affect my EFC?

Answer: Yes it does. Contributions to a retirement plan in the base year (year before you file your FAFSA) are added to your Adjusted Gross Income in the EFC formula.

Ongoing contributions during college also count when you update your FAFSA.

In addition, payments to any tax deferred pension and savings plans, whether paid directly or withheld from earnings are additions to financial aid income. For withholding from earnings, you can check your W-2 Form (Box 12, codes D,E, F, G, H, & S. These amounts are assessed.

However, your employer’s contribution does not count toward your AGI.

Example: Both parents contribute to an 401 (k), $5,000 each. The total of $10,000 would be considered an “untaxed benefit” and added back to the financial aid income calculation in your family’s EFC computation.

WARNING: There are other “traps”, for example withdrawals from Coverdell Education Savings Accounts (“CESA”) whether taxable or not will increase your AGI as well as conversions or rollovers from a regular IRA to a ROTH IRA.

![]() [Strategy Alert]: For a Roth conversion that possibly distorts your EFC, the Department of Education allows for the Financial Aid Administrator(“FAA”) to use Professional Judgment (“PJ”) to adjust your income caused by the conversion as a “special circumstance”. You must file a financial aid appeal after receiving your award letter. The FAA evaluates each appeal on a case-by-case basis.

[Strategy Alert]: For a Roth conversion that possibly distorts your EFC, the Department of Education allows for the Financial Aid Administrator(“FAA”) to use Professional Judgment (“PJ”) to adjust your income caused by the conversion as a “special circumstance”. You must file a financial aid appeal after receiving your award letter. The FAA evaluates each appeal on a case-by-case basis.

QUESTION # 2: I bought a life insurance policy when my child was young.Can I withdraw some of the cash value to help pay for college?

Answer: Yes, but with an adverse affect. Withdrawals from retirement, pension, life insurance plans are added to your Income for Financial Aid purposes. Rather than withdraw from a life insurance policy, you should consider taking “loans” which do not count toward financial aid income.

QUESTION # 3: I inherited municipal bonds that pay me tax free interest income. Do I have to report that when computing my EFC?

Answer: Any tax-exempt interest you receive is fully assessed and must be reported as untaxed income and assessed as financial aid income even though not reported as tax income.

QUESTION # 4: My children receive DIC benefits from the VA, what if anything does that mean toward my EFC?

Answer: Non-educational benefits for children (Question 44h) from the VA are assessed as income and therefore are included on the FAFSA. Veteran’s education benefits such as these below are excluded.

- Montgomery GI Bill

- Dependents Education Assistance Program

- VA Vocational Rehabilitation Program

- VEAP Benefits

QUESTION # 5: My husband was hurt on the job, and we received a lump sum worker’s compensation benefit as a result of the injury. Since this is a benefit from a work related incident, this will not count toward my EFC will it?

Answer: Unfortunately yes. All Worker Compensation awards are assessed as financial aid income.

![]() [Strategy Alert]: This might qualify as a “special circumstance” in the appeal process considered by a Financial Aid Administrator at the college/s you are applying toward. Once you receive your financial award you should appeal. You should indicate “that the one-time lump sum payment” must be used for the future support needs of your family.

[Strategy Alert]: This might qualify as a “special circumstance” in the appeal process considered by a Financial Aid Administrator at the college/s you are applying toward. Once you receive your financial award you should appeal. You should indicate “that the one-time lump sum payment” must be used for the future support needs of your family.

QUESTION # 6: I have some Series EE Savings bonds and I am considering cashing them in to help out with college. What would such a transaction mean to my possibility for financial aid?

Answer: Good question, your “interest” earned on the bonds is assessed when it is spent on qualified education expenses. The principal however is not assessed when you cash them in. For tax purposes, the interest earned is tax free. Always remember certain circumstances might be treated different between your tax return and your financial aid reporting.

![]() [Strategy Alert]: If you are considering this financial move, and you can wait until the senior year of college, then the interest would not be assessed because you are no longer qualifying for financial aid. This can also work for some other financial transactions so keep it in mind in your college planning.

[Strategy Alert]: If you are considering this financial move, and you can wait until the senior year of college, then the interest would not be assessed because you are no longer qualifying for financial aid. This can also work for some other financial transactions so keep it in mind in your college planning.

QUESTION # 7: We sold our house because we moved as a result of a job transfer. It appears we have a $50,000 gain (net proceeds less cost basis) according to our tax person. I know that this is tax free as a result of IRC Section 121, but I read that sometimes tax exclusion transactions might not always be free from being assessed on the EFC calculation. Can you give me some advice on this situation with regard to EFC non-assessable inccome and assets?

Answer: Sure, you are absolutely right to be checking about the affect on your EFC in such a financial transaction. You’re also right, it is tax free but unfortunately it does not escape the EFC calculation. The $50,000 gain is assessed and reported on your FAFSA form. This is another example of untaxed income.

![]() [Strategy Alert]: Here is another example that requires you to appeal your financial award. Such a transaction clearly distorts the family’s income on the EFC, and does not clearly reflect the family’s ability to pay for college. You have a very good argument especially when you purchased another house that might require part of the gain as your down payment.

[Strategy Alert]: Here is another example that requires you to appeal your financial award. Such a transaction clearly distorts the family’s income on the EFC, and does not clearly reflect the family’s ability to pay for college. You have a very good argument especially when you purchased another house that might require part of the gain as your down payment.

QUESTION # 8: I live in Ohio but work much of the time in Florida. My company provides me an apartment in Florida as a benefit of my job. How does this benefit affect my EFC, or does it?

Answer: Assuming your company is not reporting the benefit as a taxable benefit to you, the rental value of the apartment would be reported on your FAFSA as an addition to your adjusted gross income. This will increase your EFC.

QUESTION # 9: My daughter’s grandparents provide her a small apartment they have refinished above their garage. She does not pay them any rent. Do I have to report this and if so, what do I report on the FAFSA and where.

![]() [Strategy Alert]: Answer: Yes, “cash support” (includes grandparent provided living quarters) rules include this as a “gift” to the student. This event is untaxed income to the student and is reported in that Student FASA section.

[Strategy Alert]: Answer: Yes, “cash support” (includes grandparent provided living quarters) rules include this as a “gift” to the student. This event is untaxed income to the student and is reported in that Student FASA section.

Find Out If You Can Lower Your EFC, Increase Financial Aid Eligibillity – Click Above

How to

How to